INVESTMENT OUTLOOK & POSITIONING

December 10, 2025

Eric Kulwicki CFA®, CFP®

Wealth Advisor

Investment Consultant

Portfolio Manager

SUMMARY

- U.S. Equities: I remain slightly bullish on U.S. equities but prefer a neutral stance relative to long-term risk targets. While fiscal stimulus and Fed cuts support the market, large-cap valuations are at the higher end of historical ranges. This suggests future returns may be muted for broad large cap, market cap-weighted indices. I continue to favor diversification into mid cap and small cap stocks and across investment styles (growth, core, value), with a focus on higher quality, growing companies.

- International Equities: I have reduced my outlook to slightly bullish from moderately bullish following strong rallies in foreign equity markets. The valuation gap between U.S. and international stocks has narrowed, reducing the opportunity that existed earlier this year. While earnings growth supports continued exposure, the “easy money” may have already been made. I have taken profits in leveraged emerging market positions and prefer a more risk-neutral approach rather than holding material overweights. I continue to prefer diversification across market cap, investment styles and geographies.

- High Income-Generating Assets: I maintain a moderately bullish view on high-income assets, with income generation that can exceed 6% through diversified strategies. In an environment where equity valuations may be a bit stretched, income generation could act as a stabilizer. Although credit spreads are historically tight, I accept this risk because of extended valuations in U.S. large-cap equities. I’m still slightly bullish on closed-end funds and prefer to wait for wider discounts before increasing exposure.

- Commodities (Gold & Oil): Gold has rallied significantly this year and remains technically strong, but it may be a bit overbought over the short-term. WTI Crude Oil continues to grind lower due to global oversupply, though prices may have a fundamental floor near $50 to $55 per barrel. I remain moderately bullish on oil over the intermediate-term, anticipating that production cuts could prevent sustainable drops below that profitability threshold.

- Conservative Assets (Bonds): I am slightly bullish on conservative assets, favoring active management over passive indexing to navigate tight credit spreads. While credit-sensitive bond valuations are a bit rich, U.S. Treasuries could offer some protection if volatility rises. I generally avoid being significantly hedged on credit, as corporate balance sheets remain healthy. For high-income earners, municipal bonds might currently offer compelling value relative to Treasuries.

- Other (Hedges): I remain slightly bullish on non-traditional and hedging strategies with no immediate need for aggressive hedges. The global economy and corporate earnings are forecasted to remain solid next year, which could support asset prices. While volatility might pick up later in the year due to mid-term elections, current valuations outside of artificial intelligence and speculative areas of the market appear slightly elevated but manageable. For now, I prefer to remain patient with a neutral risk profile and without material hedges on risk assets.

Since my last Investment Outlook & Positioning piece on September 12th, global equity and bond markets have continued to grind higher overall. This year has been defined by resilience, where a combination of international market strength, the transformative potential of artificial intelligence (AI), a persistent move to gold, and investors chasing speculation.

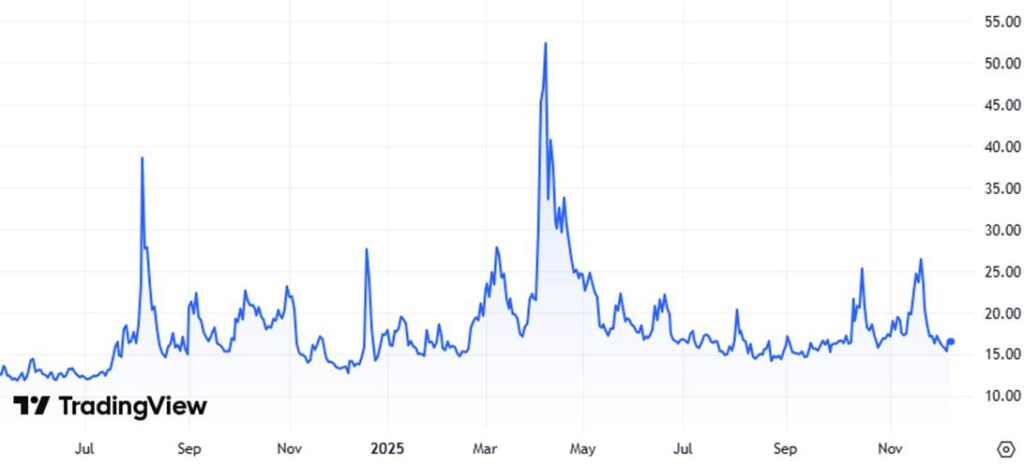

Although financial markets have been strong this year, there have been bouts of volatility. Following the spike in volatility in March and April, there was a period of subdued volatility throughout summer. Low volatility often precedes periods of higher volatility. In October and November, volatility picked up again. You can see the spike in volatility in the following chart of the S&P 500 Volatility Index (VIX).

S&P 500 Volatility Index (VIX)

Markets were forced to endure a historic 43-day U.S. government shutdown that finally ended in mid-November. While this political gridlock created headline anxiety, it technically served a healthy purpose by allowing some of the excess froth to exit the market.

While the broader indices held up, we witnessed a necessary correction in speculative excess and momentum-driven investments starting in early October and extending through November. Some of the most speculative areas, particularly individual stocks with weak profitability, were hit hard in October and November. Some stocks declined over 50% from their peaks. This sharp drawdown serves as a critical reminder of how quickly momentum in speculative, non-profitable company stocks can reverse to the downside. Since the resolution of the shutdown, we have seen a rebound, and seasonal tailwinds may continue to support the market through the end of the year.

I consider myself a patient investor and let the markets come to me. I try to take advantage of spikes in volatility and add to long-term risk positions for longer-term appreciation potential. At this time, I’m remaining patient and waiting for periods of heightened volatility to try to take advantage of again.

Fiscal Stimulus and The Fed

Investors appear to remain bullish based on the dual backdrop of fiscal stimulus and monetary easing. The One Big Beautiful Bill Act (OBBBA), signed in July, continues to flow through the economy. This stimulus is a double-edged sword: it boosts near-term growth but raises legitimate long-term deficit concerns. This structural anxiety likely explains why gold is rallying concurrently with equities. It’s a rare dynamic that may suggest investors are buying stocks for growth while buying gold to hedge against fiscal instability.

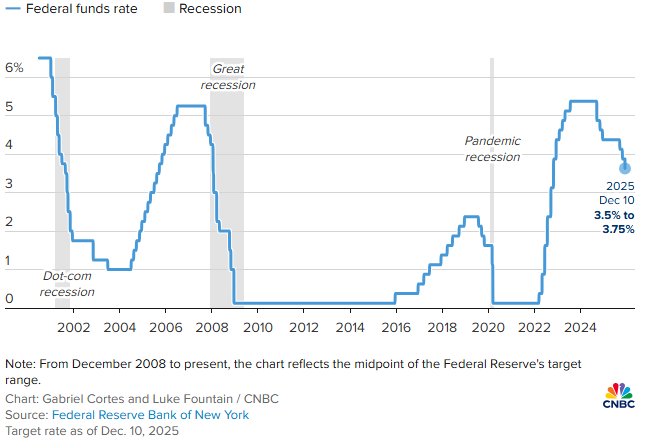

Adding to the bullish case for risk assets, the Federal Reserve resumed its interest rate cuts in September, October and just now again in December. The fed funds rate target range is now 3.5%-3.75%. The Federal Reserve is signaling a potential pause from here, with potentially limited rate cuts in 2026. With the potential for further rate cuts in the future, and probably a limited possibility for rate hikes, unless inflation reaccelerates, the monetary policy environment remains supportive of asset prices.

Fed Funds Rate

Tariffs and The Supreme Court

Despite the supportive macro environment, tariffs remain a lingering uncertainty as increased costs continue to flow through the economy. The critical question now is whether these tariffs will be sustained legally. In November, the Supreme Court heard arguments on whether the President Trump can rely on the International Emergency Economic Powers Act (IEEPA) to impose tariffs without Congress.

A decision is expected by June of next year, and the stakes are high. A ruling against the Trump administration could unwind billions in tariffs, effectively delivering a large tax cut to U.S. importers, which would be a significant positive for retail companies. Conversely, if the Court upholds the authority, it would reinforce broad executive control over trade policy, cementing tariffs as a long-term economic reality.

Looking Forward to 2026

Looking forward, 2026 is forecasted to be a solid year for U.S. earnings growth across market capitalization. This suggests we could see a “broadening out” of market performance, particularly into higher-quality companies rather than just speculative stocks. This rotation is healthy for the markets and investors alike.

As we move through the first part of next year, mid-term elections will become a primary focus, and volatility could pick up, potentially starting in the summer. At that time, investors should also start looking harder at the potential earnings and economic backdrop for 2027 and position accordingly.

The combination of Fed easing, resilient corporate earnings, and the cleared political hurdles following the shutdown resolution supports a bullish backdrop. However, leverage and valuations remain high, and next year’s mid-term elections are a factor investors will need to address.

In this environment, it does not make sense to me to be overly aggressive in my allocations. I prefer to stay neutral relative to my long-term risk profile.

My Positioning and Tactical Adjustments

I remain constructive on the broader market given the resilient corporate earnings backdrop and a generally supportive economic environment. Despite this bullish fundamental outlook, I prefer to remain risk aware. I am currently positioned neutrally relative to my long-term risk targets rather than chasing performance with material overweights in any specific area. My preference right now is to remain highly diversified.

I am currently only slightly bullish across various asset classes, preferring to remain patient and let volatility bring the market down to me, whenever that may occur. I do maintain a moderately bullish stance on high income-generating assets and strategies. In an environment where yields remain attractive, this provides a cushion against potential equity volatility.

I’m avoiding chasing assets with elevated valuations. We are seeing stretched multiples in several areas, and chasing returns doesn’t make sense to me. I’m currently fairly risk neutral, with plenty of “dryer powder” to put to work if the markets experience a deeper drawdown. If we see a deeper risk sell-off across asset classes, I will be prepared to increase risk exposure to build my longer-term positioning at more favorable valuations.

De-Leveraging Positions Following the Rally

As risk assets have continued to grind higher without significant downside volatility since March and April of this year, I have utilized this strength to prudently reduce overweight leveraged positions across my U.S. Core X and Global Unconstrained strategies. These were structural risk reductions when my price targets were hit, not based on a fundamental view on any position.

In September, as small-cap equities hit new highs, I reduced my leveraged exposure to the space. Although my large and small cap positions hit new highs and I have been reducing leverage exposure, my mid cap exposure did not hit new highs. For that reason, I have maintained a slight overweight in my leveraged mid cap exposure.

The biotechnology sector has rallied significantly since the April lows. As prices pushed aggressively to the upside, I reduced my leveraged exposure to biotech stocks in October and again in November. I am now at my smallest allocation to leveraged biotech stocks in over four years. I have actively traded this sector since establishing the initial position, trading volatile periods in the space. My recent reduction in leveraged biotech exposure reflects my price targets being hit after a nice rally higher.

I continue to maintain small leveraged exposures to Chinese equities and diversified emerging markets as we head into year-end. This is a tactical play on valuations which remain depressed compared to U.S. markets. However, this is a reduced position compared to the elevated allocations I held last year, reflecting strong rallies in these positions and an awareness of the ongoing geopolitical uncertainties.

If markets continue to grind higher, I may further reduce leveraged exposure across my exposure to U.S. mid- and small caps, Chinese equities, diversified emerging markets, and biotech stocks. If these areas do not hit my upside targets, I will remain patient and wait for the market to come to me instead.

Read Eric’s full Investment Outlook & Positioning piece on KulwickiInsights.com.